I shared this Robert Reich article (found at Guernica: A Magazine of Art and Politics) on Facebook a day or two ago. Reich's most recent book is Supercapitalism: The Transformation of Business, Democracy, and Everyday Life.

This article seems very relevant to a couple of other things posted here today, so I wanted to offer a few quotes, in relation to these posts:

Open Culture - Meltdown: The Secret History of the Global Financial Collapse

and

Reich's article is one of the best things I have read on the current financial situation in this country. The political right may ridicule Obama and claim he is waging "class warfare" by asking the very wealthy to pay a slightly higher tax rate, but this really is an issue of inequality between the elite wealthy class and the rest of us. It's amazing how in-sync the GOP is on this phrase and this theme of class warfare - they are very well organized.

And they are wrong. This is from a recent post on Reich's blog:

And they are wrong. This is from a recent post on Reich's blog:

Republicans accuse the President of instigating “class warfare.” But it’s not warfare to demand the rich pay their fair share of taxes to bring down America’s long-term debt.In the Guernica article, Reich further argues:

After all, the richest 1 percent of Americans now takes home more than 20 percent of total income. That’s the highest share going to the top 1 percent in almost 90 years.

And they now pay at the lowest tax rates in half a century — half the rate they paid on ordinary income prior to 1981.

Reviving the middle class requires that we reverse the nation’s decades-long trend toward widening inequality. This is possible notwithstanding the political power of the executive class. So many people are now being hit by job losses, sagging incomes, and declining home values that Americans could be mobilized.

Moreover, an economy is not a zero-sum game. Even the executive class has an enlightened self-interest in reversing the trend; just as a rising tide lifts all boats, the ebbing tide is now threatening to beach many of the yachts. The question is whether, and when, we will summon the political will. We have summoned it before in even bleaker times.

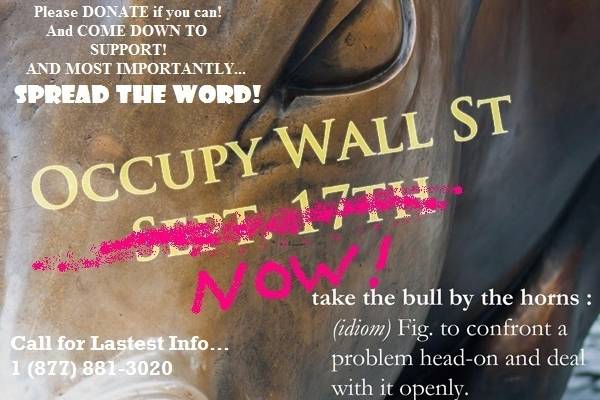

Americans are being mobilized - this article was written before the #occupywallstreet campaign (created by Adbusters) got underway. But he makes some seriously important points about the financial inequality in this country that are exactly why this campaign is happening and exactly why people are turning out every day for nearly two weeks now.

He points out in the article that when the very wealthy took home a smaller percentage of the total income, the middle class thrived and the economy grew at a record pace. But in the years when they took home a higher percentage, the economy slowed and median wages stagnated.

He points out in the article that when the very wealthy took home a smaller percentage of the total income, the middle class thrived and the economy grew at a record pace. But in the years when they took home a higher percentage, the economy slowed and median wages stagnated.

It’s no mere coincidence that over the last century the top earners’ share of the nation’s total income peaked in 1928 and 2007—the two years just preceding the biggest downturns.Excellent point. Here is the beginning of the article.

Go read the whole post.Robert Reich: Why Inequality Is the Real Cause of Our Ongoing Terrible Economy

September 6, 2011

The 5 percent of Americans with the highest incomes now account for 37 percent of all consumer purchases, according to the latest research from Moody’s Analytics. That should come as no surprise. Our society has become more and more unequal.

When so much income goes to the top, the middle class doesn’t have enough purchasing power to keep the economy going without sinking ever more deeply into debt—which, as we’ve seen, ends badly. An economy so dependent on the spending of a few is also prone to great booms and busts. The rich splurge and speculate when their savings are doing well. But when the values of their assets tumble, they pull back. That can lead to wild gyrations. Sound familiar?The economy won’t really bounce back until America’s surge toward inequality is reversed. Even if by some miracle President Obama gets support for a second big stimulus while Ben S. Bernanke’s Fed keeps interest rates near zero, neither will do the trick without a middle class capable of spending. Pump-priming works only when a well contains enough water.

Finally, here is Senate candidate Elizabeth Warren explaining why the wealthy should pay a little more taxes (and this applies to corporations, as well, in my opinion). She really gets rolling at about :55 into the video.

No comments:

Post a Comment