Here are a few recent articles on the economic and political situation in the U.S. at the current moment. Things are not looking good economically - and it seems that Obama has lost independent voters.

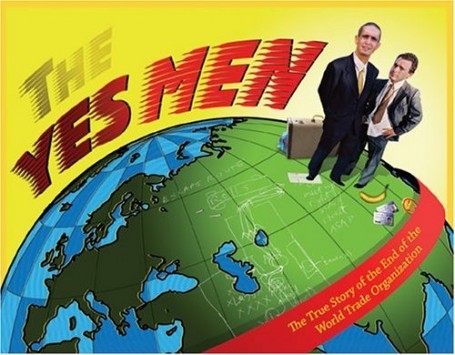

But on the bright side, a new form agit prop called pranktivism is rising with groups like the Yes Men and US Uncut. Grass roots protest, flash mobs - this is the hope I have for the future.

This is from Common Dreams/FireDogLake:

This is also from Common Dreams, via The Nation. I have include the videos with this post - the flash mob video at the Bank of America in San Francisco is pretty cool. I hadn't heard about these agit prop actions, now called pranktivism.Majority Think Wealth Should Be More Evenly Distributed

Fifty-seven percent of Americans think wealth and money should be more evenly distributed and don’t think the current situation, with a hyper-concentration of money in the hands of a few, is fair, according to the latest Gallup poll.

While there is a strong belief that wealth should be more evenly distributed, the country is more divided on whether or not the government should correct this problem by heavily taxing the rich and redistributing the wealth.

I personally think the question exhibits an unfair bias when it uses the phrase “heavily taxing.” That could mean anything from a 40 percent to a 90 percent tax rate. Given that because of the carried interest and other similar tax loopholes you have some of the richest people in America often paying lower tax rates than teachers, you could redistribute a lot of wealth by even just modestly taxing the rich. I suspect if the poll used the actual number of a 49 percent tax rate, the rate for billionaires proposed by Rep. Jan Schakowsky, it would have gotten a better response.

Regardless, we basically have half the country supporting the “socialistic” idea of heavily taxing the rich to pay for direct government wealth redistribution. That is huge, mainstream support for an idea most politicians and the traditional media would label as radically left wing.

In a political system that wasn’t so totally dependent on donations from the ultra-wealthy to finance campaigns, you would actually expect this “tax the rich to redistribute the wealth idea” to be part of the platform of one of the two major parties.

Another reminder that we aren’t a center-right country. We are just a left-wing country that happens to have a center-right government because of a rigged political system that disproportionately distributes political power to the wealthy and status quo.

© 2011 FireDogLake.com

US Uncut launched another nationwide day of protest this week involving around forty participating chapters. The activism strategies again ranged from traditional protest to more creative forms of occupations such as San Francisco’s flash mob in a Bank of America.

This latest campaign follows a busy week for the fledgling organization. US Uncut, along with the Yes Men, have been at the center of the media’s attention following their successful pranktivist duping of the AP.

The anti-corporate tax dodging movement is growing momentum during a time when GOP leaders such as Eric Cantor, Michele Bachmann, and Tim Pawlenty propagate daily the lie that corporations are already overtaxed in America. While corporations claim they’re taxed at 35 percent, their actual effective tax rate is much, much lower after deductions, credits, and write-offs.As reported at Big Think, Obama has lost the independents - according to a new Gallop poll, 35% of independents have abandoned Obama.During the 1950s, the decade in which more people joined the middle class than at any time in history - before or since - corporations paid 49 percent of their profits in taxes. Last year, it was about half that rate, a decidedly more modest 26 percent. In 2010, corporate tax collections totaled $191 billion - down 8 percent from $207 billion as recently as 2000.

Perhaps a more telling yardstick, corporate tax revenue in 2009 came to just 1 percent of gross domestic product - the lowest collection level since 1936, or three-quarters of a century ago. In 2010, it edged up to a puny 1.3 percent - the second-lowest since 1940. Even worse, the shriveled tax collections came at a time when corporations were registering an all-time high in profits. At the end of 2010, corporations posted an annualized profit of $1.65 trillion in the fourth quarter. In other words, the more they made, the less they paid.

America has a revenue problem because of a two-tier taxation system that steals from the poor and offers corporate welfare to the rich. While tax evasion has always been an American business tradition, the practice has now reached frenzied proportions where the government is no longer simply turning a blind eye to the practice, but actively facilitating it.

The Fed gave hundreds of millions of dollars in taxpayer money to hedge funds and other investors with addresses in the Cayman Islands during the bailout. The addresses belong to companies with American affiliations like Pimco, Blackstone (Pete Peterson’s company that seeks to privatize Social Security,) and Waterfall TALF Opportunity, a company owned by Christy Mack, wife of John Mack, the chairman of Morgan Stanley. The government is now actively subsidizing tax evasion by using citizen dollars to fund corporate stealing for companies like Blackstone that seek to privatize Social Security, which would rob poor Americans of one of their last great social protections.

The legend of welfare kings and queens is true, but these societal parasites don’t live in the ghettos. They live in the Hamptons and on Wall Street. Many Americans now realize this and are beginning to fight back.

Thousands turned out this week to protest Gov. Rick Snyder’s budget cuts in Michigan.

"The script Gov. Snyder has written for his Republican cronies is not the kind of Michigan we want to live in," Herb Sanders of the American Federation of State, County and Municipal Workers told the crowd. "If the politicians won't listen to us at the Capitol, then we're prepared to take the fight to them in their home districts."

Sarah Palin graced Wisconsin with her presence for the sole purpose of stating approval of Gov. Scott Walker’s decision to strip unions of the right to collectively bargain. She was enthusiastically booed by a counter-protest, a response that so flustered right-wing mouthpiece Andrew Breitbart that he rushed the podium to scream “GO TO HELL!” at the crowd before encouraging a community that had organized the event to ironically applaud the death of community organizing.

Every week, there are more teacher and students protests opposing education cuts, labor protests demanding the right to collectively bargain (not the right to higher wages or safer working conditions, but the mere right to a seat at the table,) and more citizens gather to oppose the two-tier America where the poor suffer while rich corporations raid the Treasury.

A (Gallup) study shows that only 35% of our independents now approve of the work our president is doing.

There are a variety of reasons for that. But here's the one that might be most troubling from Obama's view: Something like STAGFLATION is kicking in. Rapidly rising gas and fuel prices have pushed the the effective rate of inflation to about 6%. Meanwhile, economists say that we don't have "core inflation," because other prices and wages are basically not going up at all. So the spending power of the average American is dropping. Meanwhile, productivity numbers are disappointing. Can any of this be turned around by November, 2012? I have to admit I don't know.

We can also add there's a widespread skepticism that government can be the cure for what ails us these days, combined with the perception that the president spoke at length but didn't say much in his speech on the deficit. More and more "swing voters" are questioning the president's competence.

Good news for the president: Ryan's budget proposal is a big gamble for Republicans. In general, all entitlements in our country have been moving from DEFINED BENEFIT to DEFINED CONTRIBUTION. That is--the move, for example, from the pension to the 401k gives the individual more choice (that's good) but also sticks him or her with a lot more risk (that's bad). Ryan proposes to make that switch for MEDICARE. Given our DEMOGRAPHIC CRISIS (which I've discussed before), many responsible experts say there's no other way to make Medicare sustainable over the long term. But the change is still pretty scary for our aging population, and our president may be able to campaign effectively against the Ryan proposal.

The move from DEFINED BENEFIT to DEFINED CONTRIBUTION may be the only way to at least retard the implosion of our safety nets. It is part of a new birth of freedom understood as enhanced individual responsibility. But many or most Americans might not join THE TEA PARTIERS in regarding that move as change they can believe in.

Finally, I want to include a new article from Daniel O'Connor at Catallaxis on our monetary future. This is a long but important article, so I am only including the beginning - please go read the whole piece.

Go read the whole article.Debt Trapped: Exploring Monetary Futures

How does the growth in debt-based money relate to overall economic growth? The answer to this begins with a closer look at what happens when new money is created. Each new dollar makes its first appearance as a new asset on the books of some bank and a new liability on the books of some borrower. But there's a catch. When new dollars are loaned into existence, they are recorded on the books of both the lender and the borrower, or creditor and debtor, as the principal amount of the loan. However, the interest that the debtor will have to pay back to the bank along with the principal is not created as part of the transaction. As everyone with a 30-year mortgage should know, the interest payments can be even greater than the principal payments over the life of the loan. Few people realize, however, that our entire monetary system is structured in a similar fashion, with the total supply of money currently in circulation being dwarfed by the total future debt service payments—both principal and interest—that must be paid by all government, corporate, and household debtors.Daniel O'Connor | Integral Ventures, LLC

_____________________________________________________________With the US economy caught in a system-wide debt trap rooted in the design of its currency, our economic future is contingent upon the policy decisions currently being made by US monetary authorities and their international counterparts. An inquiry into the primary monetary policy uncertainties yields a set of diverse, yet complementary scenarios for our immediate future. These scenarios provide an interpretive frame-work for strategic decision making by entrepreneurs and executives, investors and consumers, citizens and activists.

_____________________________________________________________

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

— John Maynard Keynes

“The process by which banks create money is so simple that the mind is repelled.”

— John Kenneth Galbraith

In the midst of what many Americans understand to be a modest, though genuine, recovery from the Great Recession officially dated from December 2007 to June 2009, there remain enough lingering indicators of recession, from chronic unemployment to falling home prices, to alarm all but the most politically compromised economic pundits. While the financial crisis that punctuated this Great Recession becomes better understood through a spate of recent books and one compelling documentary, in my opinion there remains a widespread lack of appreciation for the root cause of the crisis and the continuing crisis-potential it presents. I presented my concerns about the crisis-potential in the US economy in a host of articles written from 2002 to 2006, one of which, entitled Debt Trap, explained in the simplest terms possible a fundamental flaw in the design of our monetary system for which there is no inherent fix and no easy exit.1 2

The Monetary Debt Trap

From 1971 through 2010, the total debt in the US economy—Total Domestic Debt—has grown from $1.7 trillion to $50.5 trillion, with an average annual growth rate of 9.2%. This remarkably high rate of debt accumulation is well above the 6.9% average annual growth rate in the inflation-saturated Nominal Gross Domestic Product, which grew from $1.1 trillion in 1971 to $14.7 trillion in 2010. Thus, even fully inflated economic growth has not kept pace with the growth in debt over the past 40 years. What this means, on the surface, is that the debt accumulated by all the sectors in the US economy—governments, businesses, and households—is getting progressively more difficult to service by the annual income we are all producing, regardless of whether the economy is in recession or expansion.3 4

While it has become clear to most economic observers that the US and many other developed economies face an overwhelming debt burden, it is far more important to understand why debt has been relentlessly accumulating at a rate beyond that of fully inflated economic growth. The reason is to be found in the design of our currency. The US dollar, like all national currencies these days, is a debt-based currency created, not by the government’s printing press, but through the extension of credit from the central bank, via the fractional-reserve banking system, to borrowers in the government, business, and household sectors. As each new dollar is created, a new dollar of debt is also created, and as the supply of dollars accumulates over time, so too does the balance of debt.

Where do these debtors find the additional dollars required to pay interest on their loans? In the existing supply of money already in circulation at the time of the loan, as well as any future net increases in the supply of money that precede each future interest payment. If the central bank holds the supply of money fixed from this day forth, then every debtor in the economy will be forced into a highly competitive zero-sum game to get what each one of them needs to make their debt service payments before the others get what they need. So the only way to ensure a sufficient supply of money to meet the demand of today's debtors is to systematically increase the supply of money each and every year in the future by an amount roughly equivalent to the average interest rate on all existing debt. This way there will be just enough money in circulation to ensure that just about every one of today's borrowers can get what he or she needs to pay principal and interest on their loans as it becomes due.

But there's another catch. The only way to increase the supply of money in the future is to extend additional credit and thereby create new debt over and above whatever debt is being repaid through principal payments. As we've seen, this brings with it the same constraint on future debt service, which means that the central bank will have to facilitate the creation of even more money for all the new debtors whose new loans are helping the old debtors pay their interest. So we take care of the older generation of debtors by creating a new generation of debtors who will suffer immeasurably unless the next generation of debtors fully participates in the system. Thus it continues, seemingly without end, until we have an economy so choked with old debt and so dependent on new debt that the most we can hope for is perpetual, debt-based growth in output that keeps pace with the perpetually growing debt service obligations of the entire monetary system.

Generally speaking, as central banks use the policy techniques at their disposal to promote perpetual economic growth—setting discount rates for their own lending to banks, setting federal funds rates for inter-bank lending, setting reserve requirements for banks' lending to households, businesses, and governments, engaging in open market purchases of government bills, notes, and bonds, and shaping people's perceptions of monetary policy and economic performance—they distort prices for borrowing, saving, production, consumption, employment, trade, and currency in unpredictable and unsustainable ways. Furthermore, the debt-based monetary system forces them to use all these policy techniques to achieve a sustainable rate of monetary inflation via credit expansion sufficient to provide enough money in circulation to fund the debt service obligations of the entire system. Finally, as this monetary policy is implemented through the profit-oriented fractional-reserve banking system, it results in progressively more complicated forms of credit creation inflating progressively more dangerous asset price bubbles—e.g., mortgage securitization and housing—the periodic deflation of which reveals the instability of this monetary system.

Therefore, the monetary system is designed with a built-in demand for an ever-growing supply of debt-based money that actually creates more inherent demand, enforced by an ever-growing threat of debt deflation should that supply fall too short of demand. As if defying this reality, central bankers must navigate an increasingly treacherous route between the Scylla of deflationary depression and massive debt defaults and the Charybdis of hyperinflation and currency collapse.

Tags:

No comments:

Post a Comment